For latest information, can join us at

Blog https://targetinvest88.blogspot.com

Telegram https://t.me/targetinvest88

Blog https://targetinvest88.blogspot.com

Telegram https://t.me/targetinvest88

If you are in my Telegram group, you would had noticed that I had been talking about Mclean Technologies Bhd for quite sometime. If you want to join the Telegram for FREE, yes, FREE, you can do so at https://t.me/targetinvest88

In fact, I had been talking on Mclean since the days it is trading below 20 cents. As I find this company very interesting on it's own way, the potential growth of this company opened up my eyes and mind as I compared to the peers of the industry, hence I would like to inform that I had vested interest in Mclean Technologies Bhd (MCLEAN - 0167).

Investing are tough nowadays, hence it is imperative to look for good companies to invest in growth that can burst up in a quick manner.

While Mclean is a small company that most do not know yet, it is dealing with services such as cleanroom packaging and surface treatment such as precision washing for a few sector, namely oil and gas, HDD and other electronic goods.

One of the most exciting move that Mclean had taken 5 years ago is to venture to Thailand to be nearer to it's major customer Seagate.

Source

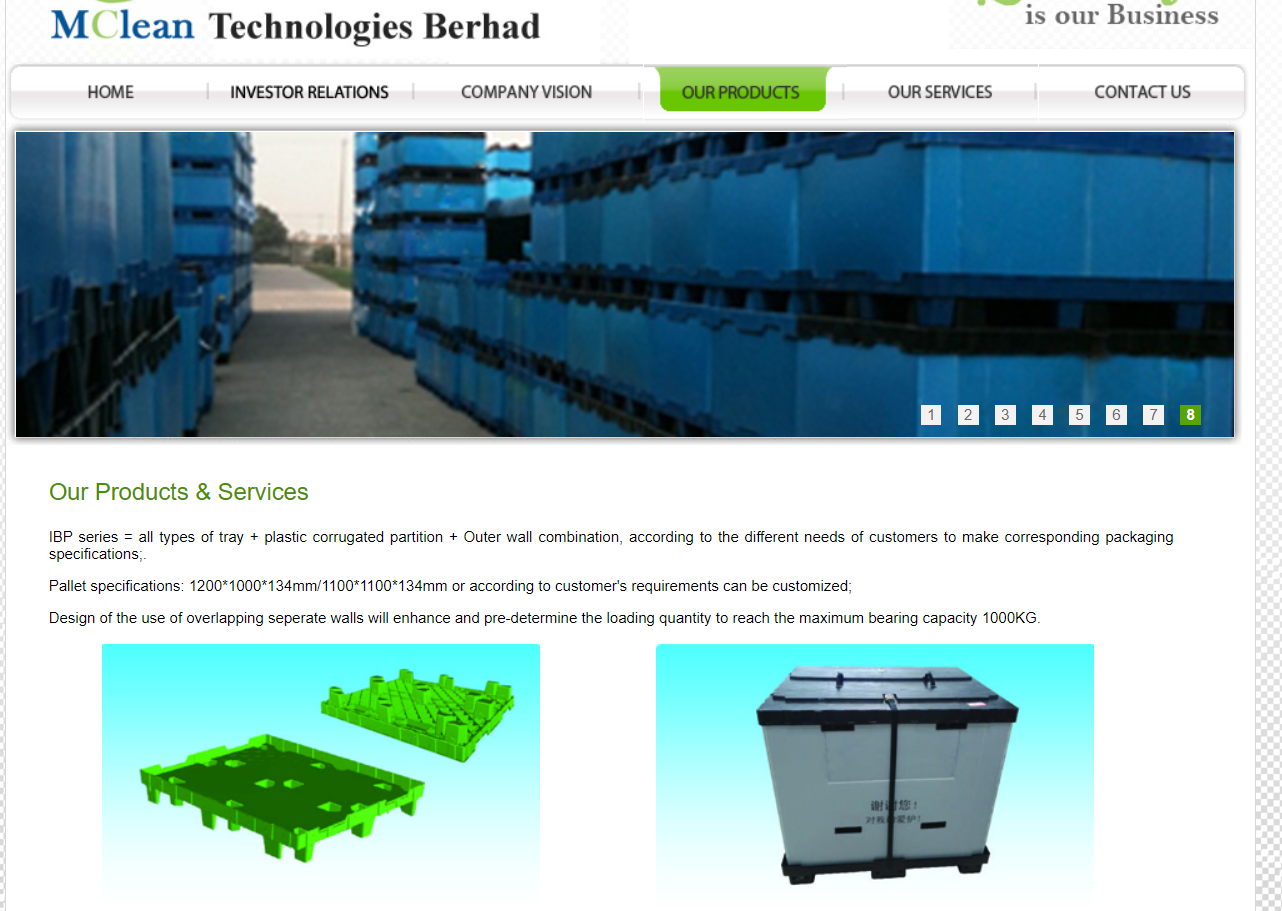

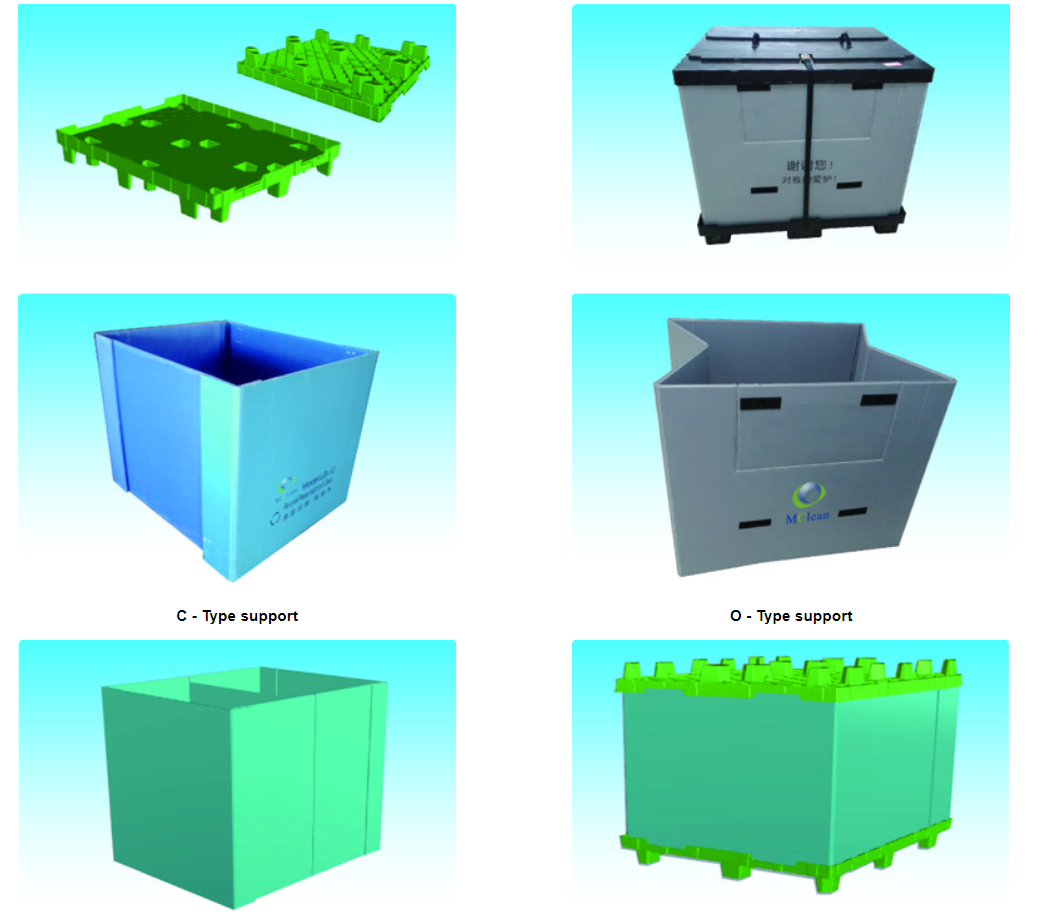

Source

Currently, Seagate owned global HDD market share 40%

What we are seeing here is could be another future technology gem riding along with global MNC growth.

According to the latest quarter report from MCLEAN, the company is expecting a improved revenue starting 2H 2021 with contribution from Thailand factory due to increase demand and orders.

Let's look at the matured player in the HDD industry scene

1. DUFU - market cap almost RM 2 billion

MCLEAN TECHNOLOGIES BHD

I believe that MCLEAN is on a good growth position by leveraging on the growth of Seagate, and also the proximity of MCLEAN with Seagate largest producing hub in South East Asia will definitely give MCLEAN a lot of better chances in the coming future.

At the current market capitalization of RM 68 million, there is just a huge growth in terms of market cap for Mclean, given competitor are sitting at RM 2 billion market cap (DUFU).

JCY RM 950 million

Notion RM 440 million

(Do note that JCY will be exiting HDD business and focus on Automotive, and Notion is also reducing on HDD business and focus on other)

So do you think Mclean will stay at market cap RM 68 million forever? With JCY and Notion exiting and reducing HDD orders, player in this industry will streamline to 2 player - Dufu and Mclean

How much is the potential for Mclean, let's talk about a 3 years time frame? RM 500 million market cap? That will be above RM 2.

Stay tune for more news on Mclean with Target Invest.

-- I have to informed that I have vested interest in Mclean, and I am not a certified financial or stock analyst. Above view is just my expression for your reference study and this is not a buy sell trade call for Mclean. Kindly do your own due diligence and consult your own resources --

For latest information, can join us at

Blog https://targetinvest88.blogspot.com

Telegram https://t.me/targetinvest88

Blog https://targetinvest88.blogspot.com

Telegram https://t.me/targetinvest88