Hello all... The latest happening in the global equity market - GAMESTOP (NYSE: GME). Sky rocket share prices that are not according to the fundamental of the company, but more towards a retail revenge towards hedge fund shorter that over-short GAMESTOP with more than 100% are putting hedge fund to brink of bankruptcy.

Welcome to the new era of trading. With so much money flushed into the capital market, gone are the days where hedge fund and IBs used to be controlling the market like how they used.

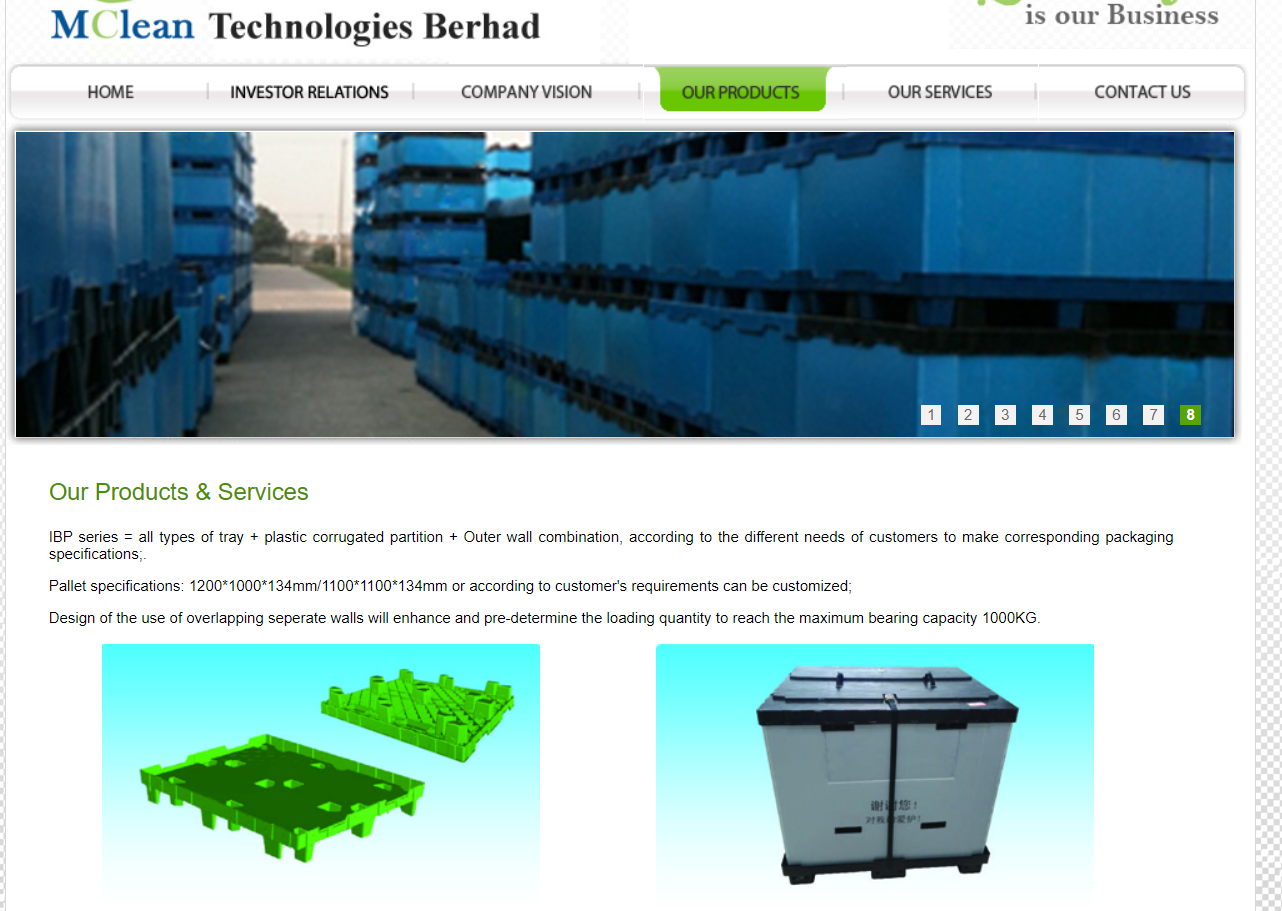

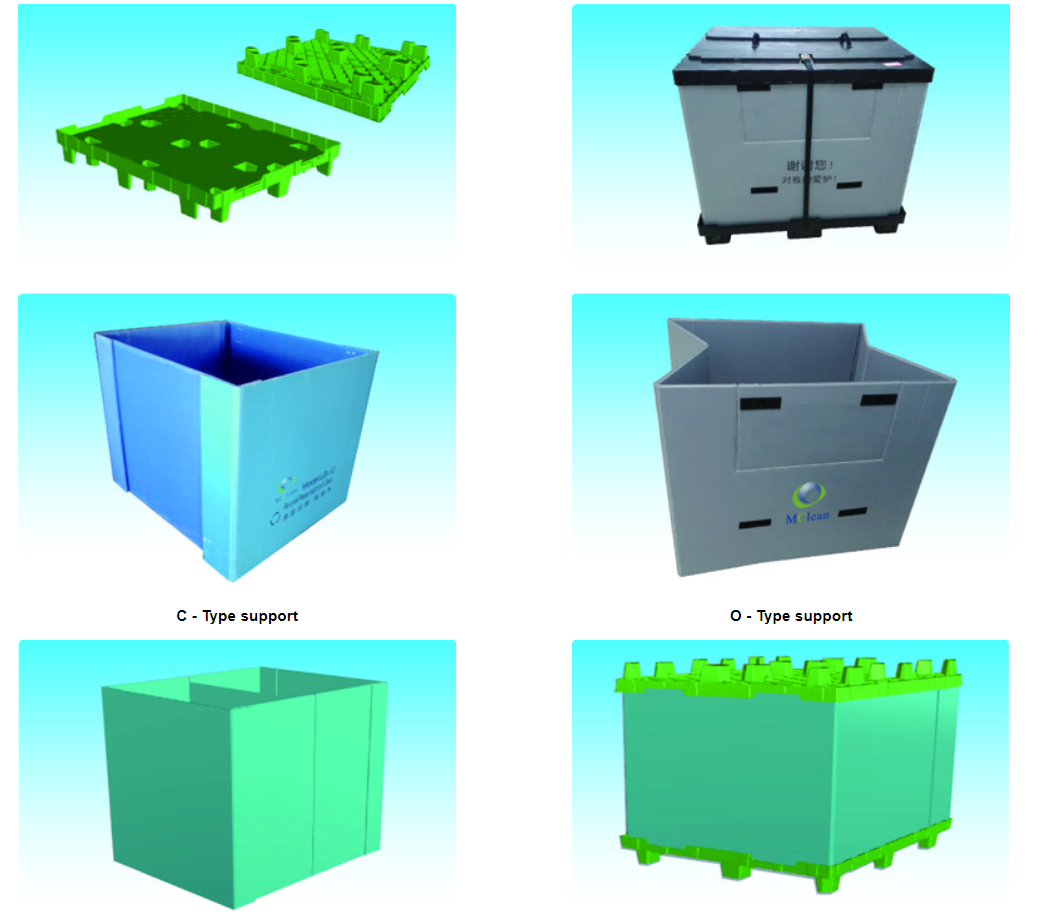

However, let's get back to business here, delivering my opinion and analysis towards this stock - MCLEAN 0167.

I have to tell you that I had this stock with me, I did mentioned about this stock for the past 2 months if you are following in my Telegram as well. But I am looking for the next 2 to 3 years with slew of interesting development that can happen to Mclean.

As I had mentioned in my previous posting, Mclean will be looking to see better revenue and profit starting 2021 due to new and increased orders from Thailand factory.

As you can see, the company involved in HDD works in Malaysia is just handful of company.

1. DUFU

2. JCY

3. Notion

4. Mclean

Let's dig deeper into all of them.

1. DUFU - Market leader, market cap RM 2 billion. Last 4 quarter cumulative revenue RM 291 million, trading at PE x40. Main focus all on HDD servives.

2. JCY - market cap RM 933 million. Last 4 quarter cumulative revenue RM 1.07 billion. trading at PE x 36. Will be diversifying into Automotive sector. HDD will reduce with 1 major customer heading for a stop on 2021 due to realignment of supply chain.

3. Notion - market cap 435 million. Last 4 quarter cumulative revenue RM 242 million. Trading PE x 70. Notion already been diversifying out from HDD business, and going more into Automotive. Currently Notion is also into gloves business.

4. Mclean - market cap 78 million. Last 4 quarter cumulative revenue RM 56 million. Smallest amongst all 4, and have the smallest share outstanding in current position, 197 millions share only.

Today, I am going to discuss about - JCY order reduction which eventually will span out to a total stop from 1 major customer. This below is the official announcement from JCY.

If you know well, JCY customer in HDD segment includes Western Digital as well as Seagate. Both are major customer. Since Seagate had redirect most sources into Thailand to make it the main production hub, there is a high level of assumption that the major customer mentioned could be Seagate? This is my assumption, alright?

Since it is a major customer, we could be possibly looking at it contributing at least 25% to 35% to JCY total revenue. Let's take an assumption of 30%, that could be looking into RM 300 million.

As you can see, at the other hand, Mclean is expecting more job at Thailand factory this year.

So I will run some numbers based on current situation assumption. Do not treat all the numbers as facts, as I do not have any real figures.

Assumption scenario

Mclean to see extra revenue of RM 200 million per annum. Benchmark on current DUFU operating net profit margin, it is 17%. I am not going to take 17%, but using 12% as net profit margin.

RM 200 million x 12% = RM 24 million.

RM 24 million / 197 million shares = 12 cents EPS

Based on PE x 40

Share price valuation will be 12 cents x 40 = RM 4.8

At RM 4.8 share price, market capitalization for Mclean will be RM 945 million.

Here is Mclean chart

This is Dufu chart (adjusted to bonus issue)

So if Mclean is really heading towards RM 4, I would say it will not be an immediate event. It will possibly takes 2 to 3 years or even 4 years to materialize. Can you hold on to your investment that long? That is a question you need to ask yourself.

IMPORTANT NOTICE

Please be informed, above are rough calculation of a normal person outlook. I am not a professional or certified analyst. Not a licensed consultant, just a normal retail investor. Please do not use my figures or data as a real referencing material. I am just sharing my thoughts of calculation, all truly based on assumption. This is not a buy sell trade reference material, please trade at your own risk or consult your own certified financial personnel.