For latest information, can join us at

The recent higher volume participation in the KLSE equity market might signal a pre-CNY rally for most of the stock that had stayed low most of the 2nd half of 2021. As we enter into 2022, it is time to start hunting for bargain chips and turnaround company.

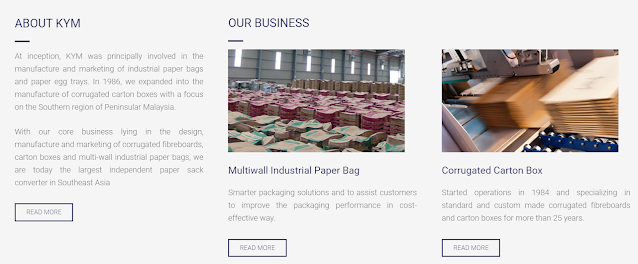

1 interesting company that you could look into is KYM HOLDINGS BERHAD (KYM - 8362). The company is dealing with manufacturing of paper packaging and corrugated carton box.

According to industry analyst, the corrugated carton players in Malaysia will be looking at steady recovery post the lockdown from Covid-19 pandemic.

The demand will be underpinned by stronger e-commerce activities as more customer prefer to shop from online. This change of customer purchasing behavior will likely to grow even throughout the year as more customer adopt to this style of online purchasing.

Malaysia is a strategic country to produce and manufactur paper pulp for the packaging industry. In March 2021 last year, the largest paper pulp producer in Asia invest RM 5.4 billion to open new factory in Malaysia.

In the technical outlook, KYM seems to have bottom out and consolidated for sometime. The technical chart suggest that KYM could be looking for a potential chart break out from the downtrend resistant line. Breaking above RM 0.42 in a strong manner will suggest a new uptrend for the share.

What do you think of KYM in the short to medium term moving forward as fundamental outlook improve and technical outlook seems to bottom out and ready to jump up.

IMPORTANT NOTICE

Please be informed that I am not a professional or certified analyst. I am not a licensed consultant, just a normal retail investor. I am just sharing my ideas and opinion on the market outlook. Any company mentioned should not be interpreted as a buy/sell/trade call. Please do your own research and buy/sell/trade at your own risk.

For latest information, can join us at

For latest information, can join us at

No comments:

Post a Comment