For latest information, can join us at

Telegram https://t.me/targetinvest88

Global energy prices are very volatile with Ukraine Russia war. The under investment on the oil and gas industry had also saw production not able to catch up with the demand as global economy reopen post pandemic.

The tension of the war had sparked strong rallies on the oil prices as well as oil refinery crack margin. Both saw strong rallies in prices back in the 1st and 2nd quarter of 2022.

However, as of the last quarter earning report in May, Hengyuan apparently appear not to be able to capture the windfall in crack margin prices.

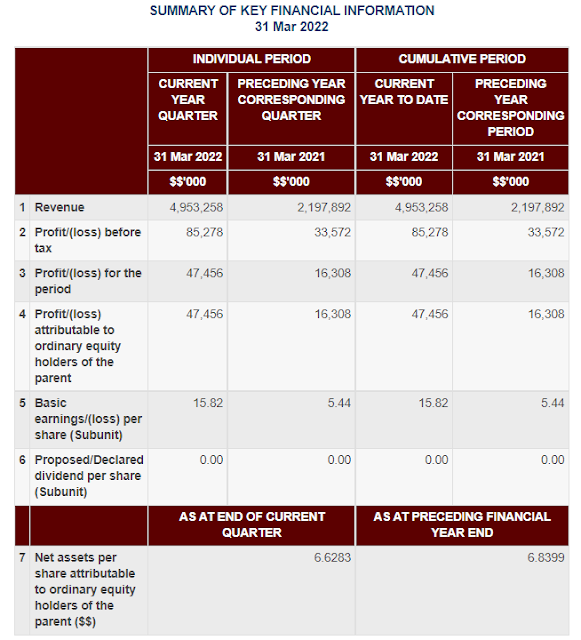

With almost RM 5 billion in revenue, Hengyuan only manage to get a profit of 47 million, turning into 15.82 in EPS.

As many investor are expecting a big improvement in the result, the result being not up to the expectation lead to a major sell down of the stock from RM 7 to RM 4.

A big chunk of gross profit being RM 508 million are knock down with big operation losses of RM 338.5 million.

Many predicted that the losses could be due to bad hedging, selling contract that are too low while crack prices go way above. While this argument can be a valid point, it can also be a important turning point moving forward.

Assuming that HENGYUAN spread out their monthly hedging by selling contract are a certain price range, for example is USD 20.

If the price continue to go up until USD 30, every contract stand to lose out USD 10. (That is losing money)

If the price go down to USD 10, every contract stand to profit USD 10 as they sold at USD 20.

MY ANALYSIS (All numbers are my own assumption for easy understanding)One of the reason for the major operational losses or hedging losses could be due to HENGYUAN do a forward hedge of 1, 2, 3, 4, 5, 6 month probably around the price of USD 25, 22, 20, 18, 15, 12 respectively (price are example)

When the crack margin prices continue to go up, all the hedging done in the forward month will be in a losing position. However, as long as HENGYUAN DO NOT CLOSE THE CONTRACT POSITION until the contract end settlement, then there is still chance for it to make a profit.

I will give you an example.

During the month of MAY 2022, lets say HENGYUAN sell 100 contract at USD 20 for the month of AUGUST. The crack margin continue to go up until USD 35. On paper, that is a paper lose of USD 15 for every 1 contract, and accounting practice will need to recognize the "paper losses" into operation losses as the contract will result in such losses at that material time.

However, if HENGYUAN held on the contract and coming to AUGUST 2022, the crack margin now is USD 10. If HENGYUAN DID NOT close all the sell contract in the month of AUGUST, then HENGYUAN will be looking for a paper profit of USD 10 per contract now.

CONCLUSIONSo, do you think HENGYUAN still have the last ride on this oil refinery saga? Do they have the golden hand where contract sold at high are still holding on to their hands until delivery?

I am not related and do not have any insider information in HENGYUAN operation. I am only a investor in HENGYUAN and still holding in HENGYUAN share as waiting for them to unveil the secret.

If you think HENGYUAN hedge master is very good and still hold a golden hand, the coming quarter report will be very powerful as it will reverse all the operation losses and turn into profit. But if the hedge master is so bad and got played up side down by the global oil syndicate, that is too bad for HENGYUAN.

For latest information, can join us at

For latest information, can join us at

No comments:

Post a Comment