Telegram https://t.me/targetinvest88

Every crisis is an opportunity. As most of Malaysian equity were settled down at the lower price range, does not this turn into an opportunity for a good bargain?

Revisit back to Mclean (0167), this company is involved in the E&E industry, specifically on surface treatment and cleaning, with major customer in the HDD industry. While the development of better HDD technology continued to keep HDD relevant in enterprise data storage, Mclean took a big step in diversifying in healthcare through asset injection from the current major shareholder - Yeo Hock Huat.

The latest proposal involving asset injection - Biocair, a Singapore based home grown brand that manufacture and sell bio-active disinfectant.

The acquisition will be funded through

- private placement

- rights issue and free warrant upon subscription

Upon completion, Mclean will own 60% of JCS Biotech Pte Ltd, which is the holding company for the disinfectant brand, Biocair.

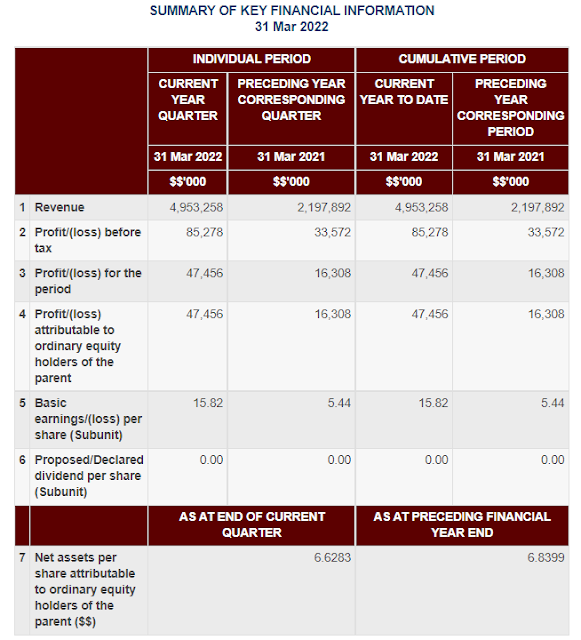

The acquisition will come with a profit guarantee of SGD 5.5 million.

The fund raising and acquisition will also provide a bridge for

Biocair to penetrate into Europe (UK) market for the start.

The market prospect for disinfectant is growing very strong, with CAGR of 41% in the global export market. The covid-19 pandemic had help raise awareness on usage of air purification in the general market.

Market observers are of the view that medical sanitization which include air purification are here to stay. This once a niche segment will be a big growing market especially in the developed country.

The BAIT AND HOOK BUSINESS MODEL

One of the strong and successful business model is bait and hook model. There are a lot of successful example in the consumer product segment which uses this business model such as water filter system and coffee maker (machine and pellets)

This business model operate on selling a one time cost hardware at a low cost, and capture a repetitive revenue from product consumption.

For Biocair, it will be selling air purifying machine for 1 time, and it will lock the customer into purchasing refillable disinfectant liquid for a period of time until the customer changes their brand preferances.

Mclean diversification into this industry will present the listed company with a better growth prospect, which will be good for investor in the long term.

After all, at a price below 20 cents, it represents an attractive prospect for investor on the future growth of Mclean.

IMPORTANT NOTICE

Please be informed that I am not a professional or certified analyst. I am not a licensed consultant, just a normal retail investor. I am just sharing my ideas and opinion on the market outlook. Any company mentioned should not be interpreted as a buy/sell/trade call. Please do your own research and buy/sell/trade at your own risk.

Telegram https://t.me/targetinvest88